Exclusive international trade finance opportunities

What is Unlisted Share’s Private Credit?

When goods are shipped internationally, importers often defer payment until delivery. This delay creates a cash flow gap for exporters, who still need to cover operational expenses during transit. Unlisted Share’s Private Credit solution bridges this gap by financing the goods in motion—offering exporters timely capital and investors a source of consistent returns.

Global Trade Credit presents a secure avenue for investors to put idle capital to work in a stable, yield-generating opportunity.

Why Private Credit?

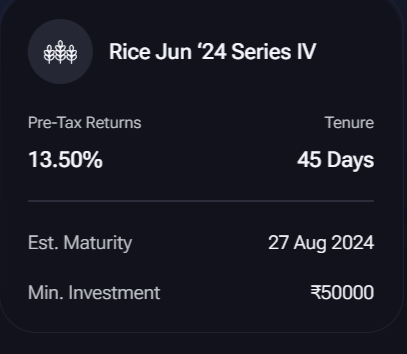

Funds are deployed solely during the transit period of goods (typically 45 to 60 days). You can access your capital shortly after the brief lock-in period.

Our innovative model focuses on financing commodities and trade flows—not individuals—removing reliance on borrower creditworthiness.

Enjoy the reliability of a fixed annualized rate of return, ensuring steady performance across all investment durations.

Unlisted Share’s Private Credit, being a debt instrument, protects your funds from market volatility—offering steady performance even in uncertain times.

Answers to your most frequent questions

What is the process for receiving my principal and interest after the asset reaches maturity?

The returns are deposited into your Precize balance, and you have the option to request a withdrawal of the funds or re-invest; there will be no charges levied on withdrawals.

How can I track my investment?

You can easily monitor your investment through the portal. It provides a comprehensive overview, including:

Asset information

Investment duration (tenure)

Returns earned

Current investment value

Estimated maturity date

All details are updated in real time, ensuring complete transparency throughout your investment journey.

Are there any withdrawal fees?

No withdrawal fees apply when you make a request.

"What documentation will serve as confirmation of my investment?"

Upon investing, you’ll enter into a formal agreement with Pazago Technologies. This agreement will act as proof of your investment and will be securely accessible at any time through your investor portal.

Is the interest earned from Private Credit taxable?

Yes, interest earned from Private Credit is taxable. If the interest earned exceeds ₹40,000 in a financial year, a 10% TDS (Tax Deducted at Source) will be applied. This deducted amount can be claimed while filing your Income Tax Return (ITR).

Are there any hidden charges?

No hidden fees—only a straightforward 0.25% upfront charge applies to every transaction.

Have a question or ready to grow your business? Reach out to our friendly team we’ll respond quickly guide you through the next steps.

- Fast Response

- Expert Support

- Clear guidance